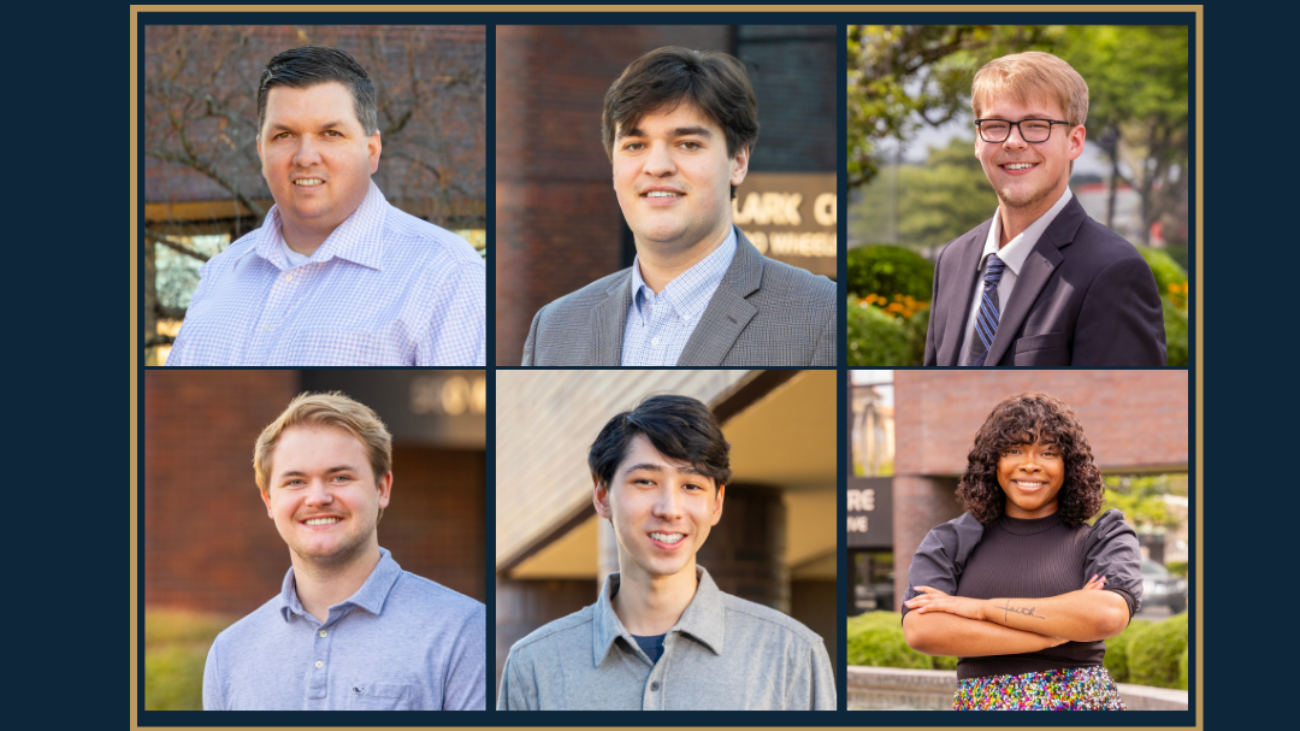

At RBG, our Core Values are more than just guiding principles — they define how we work, how we support one another, and how we continue to grow as a firm. The Core Awards were established to celebrate individuals who not only embody our core values but also inspire others through their actions and leadership.

Now in its third year, the RBG Core Awards continue to highlight those who lead by example, making a meaningful difference for our people, our clients, and our community. These awards also recognize team members who are committed to finding balance and purpose through our Live Well, Work Well initiative.

We’re proud to announce the 2025 Core Award winners — eight exceptional individuals whose contributions truly reflect the spirit of RBG.

Passion Award: Matt Day

“We spent almost four years trying to find the right person to lead CAAS, and in November 2023, we finally got it right.”

Since joining RBG, Matt Day has brought an unmistakable passion to his role. Whether he’s leading his team or exploring a new opportunity, Matt’s energy and enthusiasm elevate everyone around him. His ability to stay deeply engaged helps foster positive experiences for both our clients and our people. Matt’s arrival has been a major win for the firm, and his dedication is a shining example of what passion looks like in action.

Respect Award: Rebecca Jacobs

“Respect is a cornerstone of Rebecca’s DNA.”

Rebecca Jacobs embodies respect in every interaction. She listens with empathy, offers sound and thoughtful counsel, and consistently earns the trust of those around her. Her colleagues admire her for the calm, inclusive, and honest way she engages with others, and for building the kind of relationships that strengthen our culture. Rebecca reminds us that respect is the foundation for everything we do well together.

Ownership Award: Lauren Erickson

“Lauren takes care of all of us.”

From planning firm events to stepping up wherever help is needed, Lauren Erickson leads with ownership. She approaches every task with enthusiasm and reliability, always going above and beyond to create positive experiences. Her contributions help shape the strong and connected culture that makes RBG a great place to work. Lauren’s initiative and care are models of what it means to take full ownership of your role.

Stewardship Award: Catherine Duncan

“Catherine is one of the first people I go to when facing a difficult decision.”

Catherine Duncan’s commitment to the long-term health of the firm is unwavering. She brings thoughtful insight, balanced judgment, and an ability to focus on what’s best for both today and tomorrow. Her dedication to the firm’s ongoing success has earned her the trust of peers and leadership alike. Catherine exemplifies stewardship through her consistent focus on sustainable impact.

Teamwork Award: Morgan Ocker

“She has become an integral part of our Tax department.”

Though relatively new to RBG, Morgan Ocker has already made a lasting impact on her team. She actively mentors staff, takes the time to explain the “why” behind processes, and creates space for learning and collaboration. Whether in-person or remote, Morgan is approachable, dependable, and invested in helping others succeed. Her efforts embody the spirit of true teamwork.

Elevation Award: Akshita Purohit

“She transformed our data accuracy and reporting process.”

In just 18 months, Akshita Purohit has dramatically improved how we manage and report data. Her technical expertise in Excel and her innovative thinking have brought new levels of efficiency and accuracy to our workflows. Beyond her skills, Akshita brings patience, humor, and a generous spirit to every interaction. She’s raised the bar for what’s possible and made the journey enjoyable along the way.

Community Award: Thames Kennedy

“She helps define who we are at RBG.”

Thames Kennedy is a huge advocate for building community, both within the firm and beyond. As chair of the Service and Social Committee, she plays a key role in planning events that bring our people together and strengthen our culture. Outside of RBG, she serves on the TSCPA local board, participates in professional advocacy efforts, and encourages others to get involved. Thames’ commitment to service creates opportunities for all of us to connect and give back.

Live Well, Work Well Award: Hunter Wooley

“He’s made for exercise — and for encouraging others to join him.”

Hunter Wooley leads by example when it comes to wellness. Whether it’s working with a personal trainer, taking a cycling class, or simply walking around the office with coffee in hand, he’s always in motion. More importantly, he always encourages his coworkers to join him in his wellness activities, inspiring a firm culture of movement and balance. Hunter lives the Live Well, Work Well value daily with both authenticity and enthusiasm.

About the Core Awards

The RBG Core Awards were created to recognize individuals who embody our firm’s values in a meaningful and consistent way. The awards include:

- Passion – Invested. Enthusiastic. Beyond expectations.

- Respect – Valuing each other, our work, and those we serve.

- Ownership – Taking responsibility for outcomes and results.

- Stewardship – Acting today to ensure tomorrow’s success.

- Teamwork – Communicating and collaborating for better results.

- Elevation – Raising the bar, innovating, and enabling success.

- Community – Giving back and helping others grow.

- Live Well, Work Well – Achieving balance and well-being in life and work.

Each year, team members from across the firm come together to nominate colleagues who inspire, lead, and uplift through their actions. A representative committee thoughtfully reviews all submissions, and winners are announced at our fall firm-wide meeting. These honorees are not only celebrated at the event, they are recognized and appreciated throughout the following year for the meaningful impact they make at RBG.

Congratulations again to all of this year’s honorees. Your actions, commitment, and character set the standard for excellence at RBG, and we’re proud to celebrate your impact.

To learn more about this year’s winners, be sure to check out our Core Values page.

Q: What have you learned so far during your time at RBG?

A: “During my time at RBG I have learned how to prepare tax returns for individuals and trusts. I have also learned how to improve my professional communication and time management skills throughout this internship.”

Q: What has been your favorite part about interning at RBG?

A: “My favorite part of interning at RBG has been the people, everyone is so willing to help and answer any questions I may have. It feels like everyone tries their best to make others feel comfortable asking questions and receiving help.”

Q: Based on your experience, what’s the biggest piece of advice you’d give to a future intern?

A: “My biggest piece of advice for a future intern would be to not be too hard on yourself at first. Taxes are complicated, and I often felt down about myself or my work especially in the beginning. The point of an internship is to learn and grow, so as long as you are willing to ask questions and learn from mistakes, then you will do great!”