The Internal Revenue Code Section 25C credit, also known as the Energy Efficient Home Improvement Credit, is a valuable tax incentive for homeowners who make qualifying energy-saving improvements to their existing homes. This credit has undergone several modifications since its inception in 2006, with significant changes introduced by the Inflation Reduction Act (IR Act). Don’t confuse this credit with the one for installing home solar systems, which is in Sec 25D of the tax code. This article delves into the details of the Sec 25C credit, including credit percentages, qualified items, annual limits, home energy audits, qualifying homes, basis adjustments, and more.

Credit Percentage – For years 2022 through 2032 the credit is 30% of the sum of the amount paid or incurred by the taxpayer for qualified energy efficiency improvements installed during that year in a home used by the taxpayer as their principal residence.

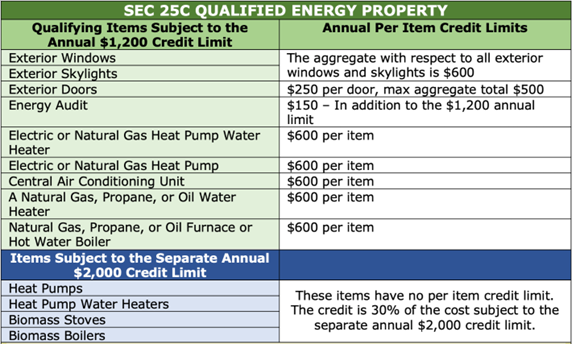

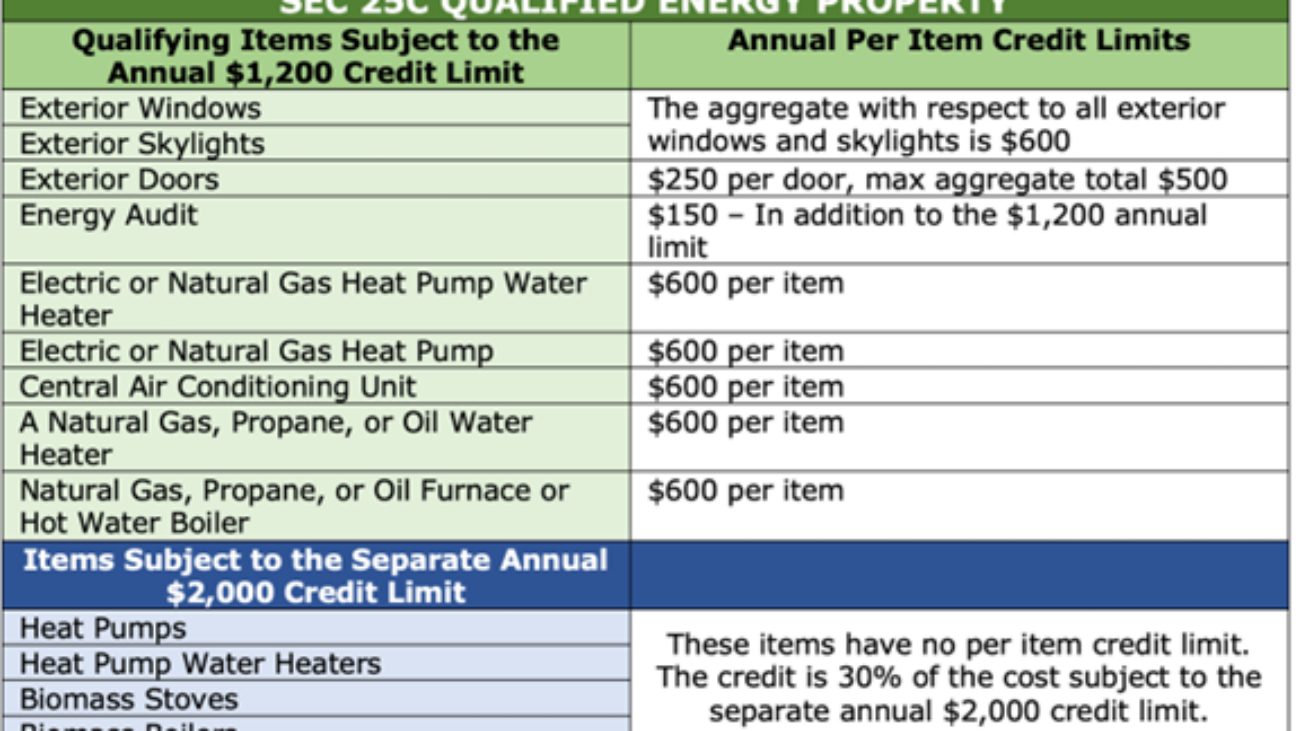

Specific Qualified Items and Per Item Annual Limits – The following energy-efficient home improvements are eligible for the Energy Efficient Home Improvement Credit:

Components Subject to an Annual $1,200 Aggregate Credit Limit:

Windows and Skylights: $600 annual limit.

Exterior Doors: $250 per door, up to a total of $500 for all exterior doors.

Central Air Conditioners, Natural Gas, Propane, or Oil Water Heaters, and Furnaces: $600

Components Subject to an Annual $2,000 Aggregate Credit Limit:

Heat Pumps and Biomass Stoves and Boilers.

Home Energy Audits – 30% of costs, up to a $150 annual limit.

Annual Credit Limits, $1,200 vs. $2,000 – The Sec 25C credit has two primary annual limits:

- $1,200 Annual Limit: This limit applies to most energy-efficient home improvements, including windows, skylights, exterior doors, and residential energy property expenditures. The $1,200 limit can be increased by up to $150 for a home energy audit, making the maximum potential credit $1,350 in a year when an audit is conducted.

- $2,000 Annual Limit: This higher limit applies specifically to heat pumps, heat pump water heaters, and biomass stoves and boilers.

Home Energy Audits – A home energy audit is an inspection and written report that identifies the most significant and cost-effective energy efficiency improvements for a dwelling unit. The audit must be conducted by a certified home energy auditor. The credit for a home energy audit is 30% of the cost, up to $150. Taxpayers can claim this credit once per year.

Qualifying Homes – Credit is only allowed for components installed in or on a dwelling unit located in the United States, and for energy-efficient building envelope components such as insulation and exterior windows and doors, the taxpayer must own and use the home as the heir principal residence. In addition, the energy-efficient property must reasonably be expected to be in use for at least 5 years.

For home energy audits, the taxpayer must own the home oruse it as a principal residence.

To claim a credit for the costs of certain types of water heaters, heat pumps, central air conditioners, furnaces, hot water boilers, stoves, boilers, and electric system improvements and replacements (collectively termed residential energy property), the taxpayer must use the home as a residence, but does not have to own the home or use it as a principal residence.

- Manufactured Homes – The term “dwelling unit” includes a manufactured home which conforms to Federal Manufactured Home Construction and Safety Standards (part 3280 of title 24, Code of Federal Regulations) (Sec 25C(c)(4))

- Original Use -The original use of such component commences with the taxpayer.

Basis Adjustment Requirements – The basis of the property is increased by the amount of the expenditure and reduced by the amount of the credit. This creates a different basis for federal and state purposes where the state does not provide a credit or if it differs from the federal credit amount.

Nonrefundable Credit, AMT, and Carryover – The Sec 25C credit is a nonrefundable personal credit, meaning it can only reduce the taxpayer’s tax liability to zero but cannot result in a refund. The credit can offset the Alternative Minimum Tax (AMT). However, there is no carryover provision for unused credits; they must be used in the year they are claimed.

Manufacturer’s Certification and Qualified Product ID Number – Taxpayers can rely on a manufacturer’s certification that a component is eligible for the credit, provided the IRS has not withdrawn the certification.

Starting after 2024, taxpayers must include the qualified product ID number of the item on their tax return for the year the credit is claimed. Omission of a correct product identification number is treated by the IRS as a mathematical or clerical error.

Differences Between Sec 25C Credit and Rebates – The Sec 25C credit is a federal tax credit claimed on the taxpayer’s tax return for the year the installation is made, while rebates are typically cash incentives provided by manufacturers, utilities, or government programs. Rebates reduce the out-of-pocket cost of the improvement, which in turn reduces the amount eligible for the credit.

For example, if a taxpayer receives a rebate for purchasing an energy-efficient window, the cost of the window is reduced by the rebate amount before calculating the credit.

Installation Costs – For certain items qualified for the Section 25C credit, the cost of both installation labor and materials can count towards the credit. Specifically, the credit covers:

- Residential Energy Property – This includes items such as heat pumps, biomass stoves, and biomass boilers. For these items, the credit is 30% of the costs, including labor, up to $600 for each item, provided they meet the energy efficiency requirements specified.

- Building Envelope Components – This includes items like insulation, exterior windows, skylights and doors. However, for these components, the cost of installation labor is not included in the credit calculation—only the cost of the materials themselves is eligible.

Planning Modifications to Maximize Credits – Taxpayers can strategically plan their energy-efficient home improvements over several years to maximize the credits. By spreading out the improvements, taxpayers can take advantage of the annual limits each year.

The Sec 25C credit for energy-efficient home modifications offers significant tax savings for homeowners who invest in energy-saving improvements. By understanding the credit percentages, qualified items, annual limits, and other requirements, taxpayers can make informed decisions and maximize their benefits. Whether it’s through home energy audits, upgrading heating systems, or installing new windows, the Sec 25C credit provides a valuable incentive for making homes more energy-efficient and reducing overall energy costs.

Please contact our office to see if and how you might benefit from this credit.

Q: What have you learned so far during your time at RBG?

A: “During my time at RBG I have learned how to prepare tax returns for individuals and trusts. I have also learned how to improve my professional communication and time management skills throughout this internship.”

Q: What has been your favorite part about interning at RBG?

A: “My favorite part of interning at RBG has been the people, everyone is so willing to help and answer any questions I may have. It feels like everyone tries their best to make others feel comfortable asking questions and receiving help.”

Q: Based on your experience, what’s the biggest piece of advice you’d give to a future intern?

A: “My biggest piece of advice for a future intern would be to not be too hard on yourself at first. Taxes are complicated, and I often felt down about myself or my work especially in the beginning. The point of an internship is to learn and grow, so as long as you are willing to ask questions and learn from mistakes, then you will do great!”