Making Home Improvements? You May Qualify for a Substantial Tax Credit

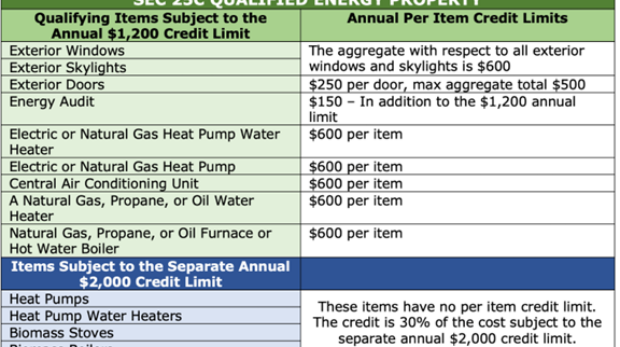

The Internal Revenue Code Section 25C credit, also known as the Energy Efficient Home Improvement Credit, is a valuable tax incentive for homeowners who make qualifying energy-saving improvements to ...